Lenahan & Dempsey is at the forefront of Insurance Bad Faith cases in Pennsylvania.

Attorney Timothy Lenahan, Managing Partner at Lenahan & Dempsey, along with Attorney Christine S. Lezinski, were the trial and appellate legal counsel in the landmark case of Hollock v Erie. This case, which we won in front of the Pennsylvania Supreme Court, helped establish Bad Faith laws in Pennsylvania.

Thanks to Attorney Lenahan’s and Attorney Lezinski’s efforts and legal skills, this groundbreaking case established the right of individuals to be treated fairly by their insurance companies and, when they fail to do so, insurance companies can be held liable for often severe penalties known as “punitive damages,” which can be far in excess of the value of the original insurance claim.

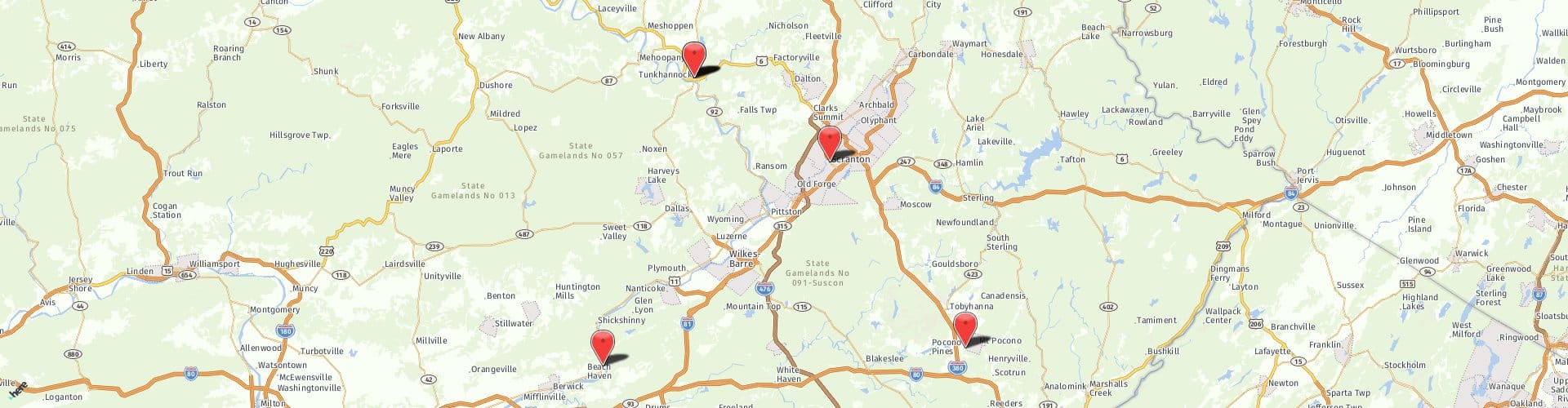

Attorney Timothy Lenahan was named by Best Lawyers In America as the Insurance Lawyer of the year for 2024-2025 for his work protecting the rights of the injured against giant insurance companies for the region of Northeastern/Central Pennsylvania and the Pocono Mountains. He is a past Best Lawyers in America Personal Injury Lawyer of the Year for that region for his work fighting for the rights of injured people.

Eight of our lawyers have been named to both Best Lawyers in America as well as Pennsylvania Super Lawyers. Three, John R. Lenahan, Jr (our Firm President), Timothy Lenahan and Matthew Dempsey are named to The Top 100 Lawyers in Pennsylvania (out of over 48,000 lawyers in Pennsylvania).

Our success in winning Hundreds and Hundreds of Millions for our clients has also led to Judges and our peers voting us for inclusion in The Best Law Firms in America, and we are listed as a Tier 1 law firm (the highest rating).

We Are The Insurance Bad Faith Law Firm

Because the attorneys from Lenahan & Dempsey were counsel in a landmark Hollock case that established bad faith rules in Pennsylvania, we are uniquely qualified to fight for you if you are the victim of Insurance Bad Faith.

Understanding The Basics of Insurance Bad Faith

Insurance bad faith typically occurs when an insurance company fails to meet its obligations to its insured under the policy in a timely and fair manner. This can involve a wide range of actions, including unreasonably denying a claim, delaying payment without justification, processing the claim unreasonably slowly or offering an unreasonably low settlement.

Commercial Bad Faith

Bad faith cases are not limited to individuals. We have seen bad faith cases where a business is denied a legitimate claim by an insurance company. This can also be an example of Insurance Bad Faith.

Examples of Insurance Bad Faith

Insurance companies maintain staff lawyers and hire outside legal counsel in an effort to keep their costs down. Insurance companies often cross the line into Bad Faith. Here are just a few examples of Insurance Bad Faith:

1. Unreasonable denial of a claim without a valid reason

2. Failure to investigate a claim in a timely manner

3. Delaying payment of a claim without justification

4. Offering an unreasonably low settlement amount

5. Misrepresenting policy provisions or coverage limits

Legal Remedies Available To You

Under the laws in Pennsylvania, if the insurance company breached its insurance contract with you, you may be entitled to compensatory or consequential damages. This can include the amount of the original claim, plus additional damages caused by or flowing from the insurance company’s conduct.

In addition, under the bad faith statute in Pennsylvania, where an insurance company is found to have acted in bad faith towards its insured, the following damages may be awarded against the insurance company: Punitive damages: to punish the insurance company and deter future bad faith behavior by the insurance company and other insurance companies.

Attorney’s fees and court costs

Interest on the insurance claim based on the prime rate plus 3%, from the date the claim was made to the date of payment.

Never Sign Anything From An Insurance Company

The best advice we can give anyone involved with an insurance claim is to never sign any documents until we have reviewed the paperwork. You may unknowingly sign away valuable rights or even waive your right to proceed with a claim. The documents you will be asked to sign were prepared by insurance lawyers to protect the insurance company. Call us to review any and all documents before you sign them.

Lenahan & Dempsey Can Help

Insurance Bad Faith Cases are a frustrating and stressful experience for those who are dealing with the physical, emotional, and financial effects of a personal injury or property damage claim which are then compounded by the mistreatment by their own insurance company.

We can help you.

We’re available 24/7 at 1.888.536.2328. Call us today for a free, no-obligation case evaluation. There are no fees until you get the money you deserve.

What Can You Expect When Working With Lenahan & Dempsey

We have recovered Hundreds and Hundreds of Millions for our clients across almost all fields of Personal Injury, Insurance Bad Faith and Workers’ Compensation law.

We fully understand the physical, emotional, and financial toll a case can take on victims and their families. Our highly dedicated team of lawyers and paralegals can point to a history of success supporting our clients and winning the money they need to rebuild their lives.

*Best Lawyers in America and Best Law Firms are trademarks of Woodward White. Super Lawyers and Top 100 Lawyers in Pennsylvania are trademarks of Thompson Reuters. Both trademarks are used with permission. Details on Settlements & Verdicts are found at LenahanDempsey.com. All law firms are required to note that because the facts of each case are different, past performance is not a promise of a future outcome.